($106.8 billion) Insights into the Travel Insurance Market Growing at CAGR of 20.1% | Understanding Coverage and Claims

($106.8 billion) Insights into the Travel Insurance Market Growing at CAGR of 20.1% | Understanding Coverage and Claims

NEW CASTLE, DELAWARE, UNITED STATES, August 5, 2024 /EINPresswire.com/ -- The value of global travel insurance premiums is expected to be almost seven times higher than in 2022 to reach $107 billion in 2032, attaining a growth rate of 20.1%. The report titled “Travel Insurance Market” reflects on the current growth of travel insurance, emphasizing notable trends and opportunities on a global scale as well as across different regions. Business leaders and companies can harness these insights to engage with this significantly growing sector.

The global travel insurance market is experiencing significant growth owing to the increasing number of people traveling for business and vacations purposes which is significantly driving to the expansion of the market. The rising awareness of the potential risks associated with travel, such as medical emergencies and trip insurance, fueled the demand for travel insurance as a means of protection.

𝐂𝐥𝐚𝐢𝐦 𝐘𝐨𝐮𝐫 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂: https://www.alliedmarketresearch.com/request-sample/1610

The travel insurance market trends include regulatory requirements in certain countries mandating travel insurance, further boosted market growth. However, the market face challenges, including low awareness and price sensitivity among the travelers. Moreover, the adoption of digital technologies such as AI and ML by key providers for prompt response and customized plans is providing numerous opportunities for market growth. Travel health insurance emphasis on healthcare protection and COVID-19 coverage reassures travelers, fueling demand and expanding the travel insurance market.

Allied Market Research published a report, titled, "Travel Insurance Market by Insurance Cover (Single-Trip Travel Insurance, Annual Multi-Trip Travel Insurance, and Long-Stay Travel Insurance), Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Insurance Aggregators), End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and Age Group (1-17 Years Old, 18-30 Years Old, 31-49 Years Old, and Above 50 Years): Global Opportunity Analysis and Industry Forecast, 2022-2031, and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032."

𝐓𝐡𝐞 𝐥𝐨𝐧𝐠-𝐬𝐭𝐚𝐲 𝐭𝐫𝐚𝐯𝐞𝐥 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐬𝐞𝐠𝐦𝐞𝐧𝐭 𝐭𝐨 𝐦𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐥𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐬𝐭𝐚𝐭𝐮𝐬 𝐭𝐡𝐫𝐨𝐮𝐠𝐡𝐨𝐮𝐭 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

By insurance cover, the single-trip travel insurance segment held the largest market share in 2022, accounting for more than three-fifths of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to its comprehensive coverage for a single journey, including trip cancellations, medical emergencies, and baggage loss, providing travelers with peace of mind. However, the long-stay travel insurance segment is projected to manifest the highest CAGR of 23.8% from 2023 to 2032, owing to the increasing number of long-term travelers seeking comprehensive insurance coverage for extended stays abroad.

𝐓𝐡𝐞 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐚𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐨𝐫𝐬 𝐬𝐞𝐠𝐦𝐞𝐧𝐭 𝐭𝐨 𝐦𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐥𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐬𝐭𝐚𝐭𝐮𝐬 𝐭𝐡𝐫𝐨𝐮𝐠𝐡𝐨𝐮𝐭 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

By distribution channel, the insurance intermediaries segment held the largest market share in 2022, accounting for nearly one-third of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to its wide network, personalized services, and strong customer relationships, which cater to the diverse needs of travelers efficiently. However, the insurance aggregators segment is projected to manifest the highest CAGR of 23.0% from 2023 to 2032, owing to its ability to offer a wide range of insurance options from different providers, providing customers with greater choice and convenience in selecting suitable policies.

𝐁𝐮𝐲 𝐓𝐡𝐢𝐬 𝐄𝐱𝐭𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 (𝐏𝐃𝐅 𝐰𝐢𝐭𝐡 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐂𝐡𝐚𝐫𝐭𝐬, 𝐓𝐚𝐛𝐥𝐞𝐬, 𝐚𝐧𝐝 𝐅𝐢𝐠𝐮𝐫𝐞𝐬) @ https://bit.ly/3CkKQOF

𝐓𝐡𝐞 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐭𝐫𝐚𝐯𝐞𝐥𝐞𝐫𝐬 𝐬𝐞𝐠𝐦𝐞𝐧𝐭 𝐭𝐨 𝐦𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐥𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐬𝐭𝐚𝐭𝐮𝐬 𝐭𝐡𝐫𝐨𝐮𝐠𝐡𝐨𝐮𝐭 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

By end user, the family travelers segment held the largest market share in 2022, accounting for nearly one-third of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to the rising number of families opting for travel insurance to protect their loved ones against unforeseen events such as medical emergencies and trip cancellations. However, the business travelers segment is projected to manifest the highest CAGR of 22.6% from 2023 to 2032, owing to the increasing globalization of businesses, rising frequency of business trips, and the need for comprehensive coverage against travel-related risks for employees on corporate travel.

𝐓𝐡𝐞 𝟏𝟖-𝟑𝟎 𝐲𝐞𝐚𝐫𝐬 𝐨𝐥𝐝 𝐬𝐞𝐠𝐦𝐞𝐧𝐭 𝐭𝐨 𝐦𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐥𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐬𝐭𝐚𝐭𝐮𝐬 𝐭𝐡𝐫𝐨𝐮𝐠𝐡𝐨𝐮𝐭 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝.

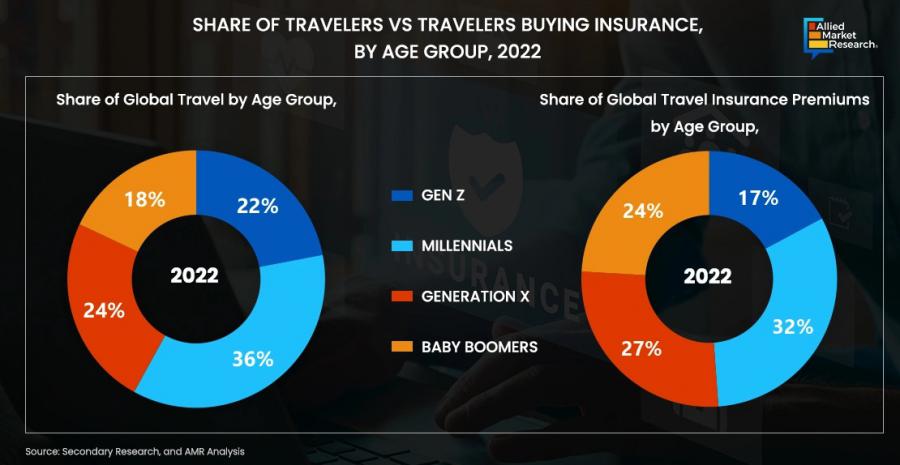

By age group, the 31-49 years old segment held the largest market share in 2022, accounting for more than one-third of the travel insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, owing to its active participation in travel activities, higher disposable income, and a growing awareness of the importance of travel insurance, especially for longer trips. However, the 18-30 years old segment is projected to manifest the highest CAGR of 23.0% from 2023 to 2032, owing to the increasing number of young travelers seeking adventurous and experiential travel experiences, leading to a higher demand for travel insurance among this demographic.

𝐀𝐬𝐢𝐚-𝐏𝐚𝐜𝐢𝐟𝐢𝐜 𝐫𝐞𝐠𝐢𝐨𝐧 𝐭𝐨 𝐦𝐚𝐢𝐧𝐭𝐚𝐢𝐧 𝐢𝐭𝐬 𝐝𝐨𝐦𝐢𝐧𝐚𝐧𝐜𝐞 𝐛𝐲 𝟐𝟎𝟑𝟐.

By region, the Europe segment held the largest market share in terms of revenue in 2022, accounting for nearly two-fifths of the travel insurance market revenue, owing to the region's robust tourism industry, high awareness about travel risks, and the availability of a wide range of travel insurance products tailored to different traveler needs, which is boosting the growth of the market in this region. The Asia-Pacific region is expected to witness the fastest CAGR of 22.1% from 2023 to 2032, owing to the increasing awareness about travel insurance, rising disposable incomes, and a growing number of outbound travelers, particularly from countries like China and India, driving the demand for travel insurance policies in the region.

𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐥𝐚𝐲𝐞𝐫𝐬: Assicurazioni Generali S.p.A., Just Travel Cover, Zurich Insurance Group, Staysure, PassportCard, Trailfinders Ltd., AXA, American International Group, Inc., Aviva, Insurefor.com

𝐆𝐞𝐭 𝐘𝐨𝐮𝐫 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥𝐢𝐳𝐞𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 & 𝐓𝐎𝐂 𝐍𝐨𝐰! @ https://www.alliedmarketresearch.com/request-for-customization/1610

𝐓𝐫𝐚𝐯𝐞𝐥 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬

By Age Group

Above 50

1–17 Years Old

18–30 Years Old

31–49 Years Old

By Insurance Cover

Single-Trip Travel Insurance

Annual Multi-Trip Travel Insurance

Long-Stay Travel Insurance

By Distribution Channel

Insurance Intermediaries

Insurance Companies

Banks

Insurance Brokers

Insurance Aggregators

By End User

Senior Citizens

Education Travelers

Business Travelers

Family Travelers

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Norway, Netherlands, Spain, Italy, Switzerland, Finland, Belgium, Russia, Sweden, Austria, Rest of Europe)

Asia-Pacific (China, Japan, Australia, Hong Kong, South Korea, Malaysia, Singapore, New Zealand, Rest of Asia-Pacific)

LAMEA (Brazil, Argentina, Rest of Latin America, Middle East, Africa)

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: 𝐈𝐧𝐬𝐢𝐝𝐞𝐫'𝐬 𝐆𝐮𝐢𝐝𝐞 𝐭𝐨 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞@ https://www.alliedmarketresearch.com/request-for-customization/1610

𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬 𝐚𝐧𝐝 𝐅𝐮𝐭𝐮𝐫𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞

Rise in innovation demonstrates the travel insurance industry's ability to adapt to changing consumer needs and new trends in the global travel industry. Advancements in technology and changing travel patterns lead to new innovations aimed at improving the availability, flexibility and reliability of travel insurance products and services.

𝐃𝐢𝐠𝐢𝐭𝐚𝐥𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐚𝐧𝐝 𝐎𝐧𝐥𝐢𝐧𝐞 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬

Many travel insurance companies have moved to digital platforms that allow customers to purchase policies, manage claims, and access support services online or through mobile apps. Digital platforms provide convenience, accessibility, and real-time updates, improving the overall customer experience. In September 2022, insurtech startup, InsuranceDekho, expanded its service offering by launching travel insurance on its online platform. The company has partnered with leading insurance organizations such as Reliance General, Bajaj Allianz, ICICI Lombard, and others to offer travel insurance services on a regular basis

𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐯𝐞 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐟𝐨𝐫 𝐀𝐝𝐯𝐞𝐧𝐭𝐮𝐫𝐞 𝐓𝐫𝐚𝐯𝐞𝐥

With rise in popularity for adventure travel and extreme sports, insurers are developing specific insurance options for activities such as hiking, diving, and skiing. These policies provide comprehensive protection against injuries, property damage, and trip disruption associated with adventure travel. In October 2021, Travel Insured International, Inc. launched cruise travel protection plan that provides coverage up to $50,000 in accidental & sickness medical expense and up to $250,000 in medical evacuation coverage. It also provides protection for missed cruise connection, cruise disablement, and cruise diversion.

𝐅𝐮𝐭𝐮𝐫𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤 𝐟𝐨𝐫 𝐌𝐚𝐫𝐤𝐞𝐭

The future of the travel insurance market is expected to evolve significantly due to various factors that are changing the travel landscape. Technological advances, changing consumer behaviour, and global events such as the COVID-19 pandemic are driving the market growth. Technological advancements are revolutionizing the way users purchase, manage, and report travel insurance. Mobile apps, AI-powered chatbots, and digital platforms provide convenience and personalization, enhancing the overall customer experience. Consumer inclination towards travel insurance is also changing. Higher awareness of the health and safety issues caused by the pandemic has highlighted the importance of comprehensive protection. Travelers are increasingly looking for policies that offer protection against unexpected events, including medical emergencies, cancellations, and trip interruptions.

Partnerships with airlines, travel agencies, and online platforms are anticipated to further expand distribution channels and reach a wider audience. In addition, rise in educational initiatives are expected to play a key role in increasing consumer understanding and awareness of the benefits and options of travel insurance. Overall, the future of the travel insurance market lies in innovation, adaptability, and customer-focused solutions that meet the changing needs of travelers in an increasingly complex global environment. Get in touch with AMR analysts for more information.

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Online Payday Loans Markethttps://www.alliedmarketresearch.com/online-payday-loans-market-A157231

Extended Warranty Markethttps://www.alliedmarketresearch.com/extended-warranty-market

Consumer Electronics Extended Warranty Market https://www.alliedmarketresearch.com/consumer-electronics-extended-warranty-market-A14248

Cryptocurrency Market https://www.alliedmarketresearch.com/crypto-currency-market

Blockchain in Insurance Market https://www.alliedmarketresearch.com/blockchain-in-insurance-market-A11767

EV Insurance Market https://www.alliedmarketresearch.com/ev-insurance-market-A47384

David Correa

Allied Market Research

+1 800-792-5285

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.